S K Y L I N E | Cost of Entry

Friends of NYRA reflect on Biden’s loan forgiveness, plus delightful dispatches.

Issue 81. Happy Labor Day weekend to all architectural workers. Take the next three days off, we bet it will do you good. And it will give you time to read our print edition. Start a subscription today.

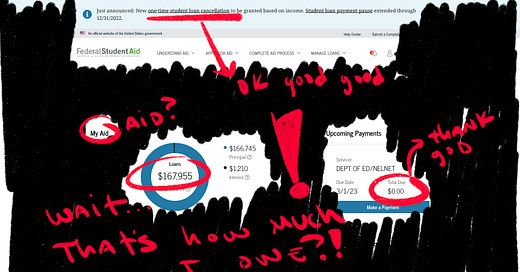

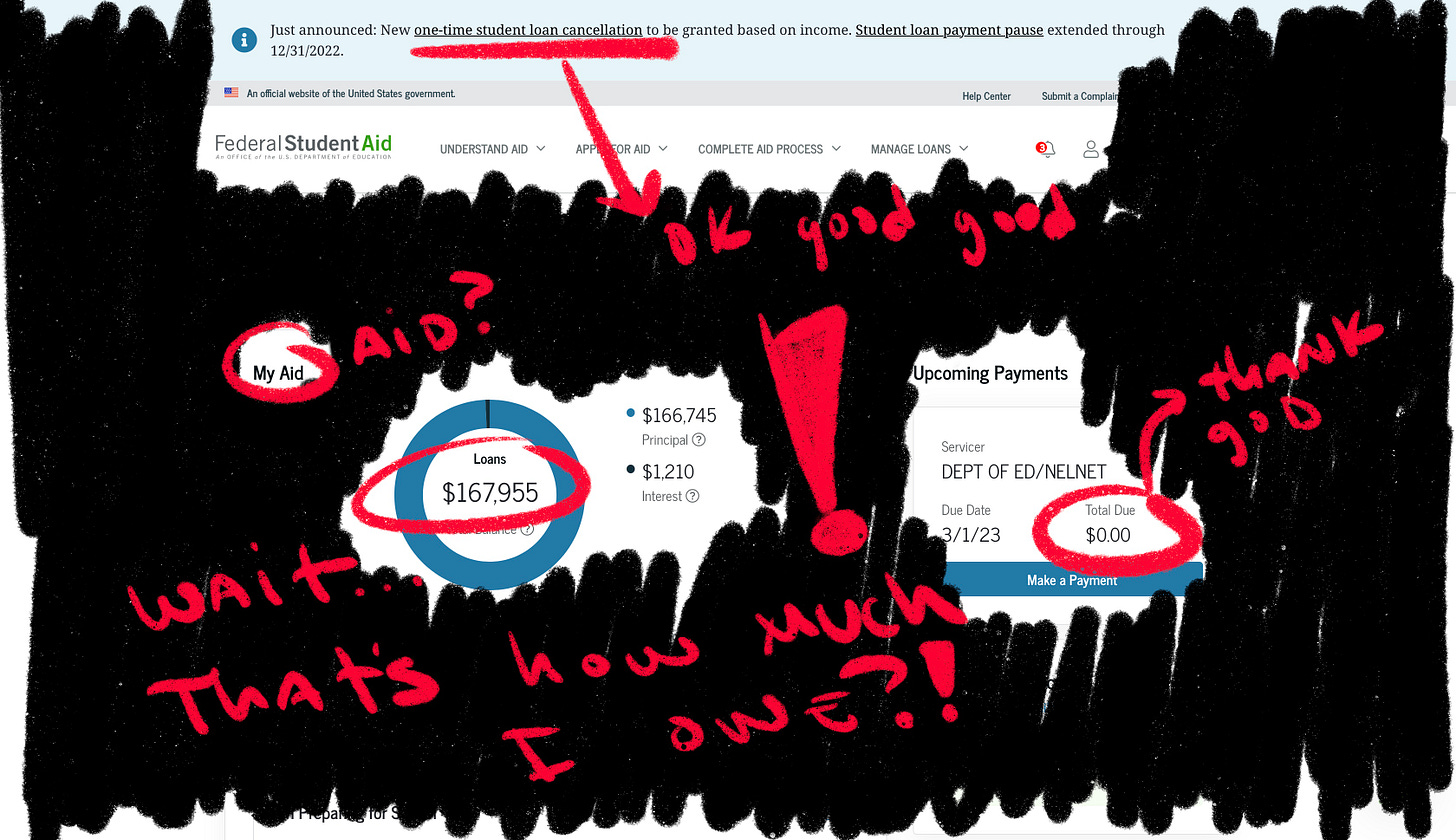

The cost of tuition and the licensure process have kept many people from attempting to become architects—particularly Black and Latinx people—but even those who overcome these hurdles have to face an even bigger problem that has now become a major crisis not only in the profession but in the whole country. According to the Student Debt Crisis Center, as of 2020, Americans owe more than $1.7 trillion in student debt. Last week, President JOE BIDEN announced $10–20K student loan relief for borrowers making under $125K a year. In light of this wonderful, though limited, attempt at helping American workers, we asked our writers and readers to share their student debt stories. Does $10–20K in loan forgiveness make an impact on architects at all? And who are the most affected by the burden of debt in our profession?

When I came to New York for my M.Arch, I did it knowing full well that the cost of tuition would be astronomical, but perhaps, so were my ambitions—and so are they for thousands of architects in this country who trust there will be a return on investment. When confronted with the risk of possible future financial insecurity, my thinking was “so be it, I wouldn't be much better off, anyway.” Irresponsible thinking, perhaps, but graduate school was certainly a transformative experience: it expanded my horizons, connected me to people I wanted to meet, and allowed me to discover how I want to engage with architecture. The intensity of this newfound freedom finds its match in the intensity of my financial burden. I often get the sense that I have no other choice but to follow the safest path available, regardless of where my “illuminated spirit” wants to take me.

What’s holding me back? Retirement. It might seem like I’m getting ahead of myself, but the youngest cohort of architecture professionals—who have come of age amidst crises—is having to choose between past or future: paying off their student loans or contributing to their retirement funds. According to the Federal Reserve, forty-two percent of Americans between eighteen and twenty-nine years old have no retirement savings; that figure jumps to sixty percent if you count only those under twenty-five. By the time this cohort reaches retirement age, they will have already faced exorbitantly high tuition for their degrees, multiple recessions, stagnant starting salaries that kept up with neither inflation nor tuition, and the first global pandemic in a century—and they will also have to face not having enough money to actually stop working. This will affect everyone, of course, but it will disproportionately affect those whose families were not able to accumulate generational wealth to pass down to their children. The problem is so dire that the AIA has made retirement its focus in their campaign for fair loan programs and has launched an initiative advocating for congress to support legislation that would allow employers to count an employee’s student loan payment as the matching requirement for retirement.

We want to foster a conversation on this topic. It’s no fun to talk about owing tens of thousands of dollars, so the few stories our writers and readers shared this week are valuable. It took courage and effort to sit and write them down. We’re publishing them here not to discourage anyone from entering our field, but rather to shed light on how acutely these issues affect it.

— Osvaldo Delbrey Ortiz

FRIENDS OF NYRA ON STUDENT LOANS

An International

As an international student, I didn't have much choice when it came to borrowing money to finance my studies in the US—private borrowing through the university was the only immediately available option—so the recent legislation will not affect my remaining student debt. And yet I support it wholeheartedly and only wish it would be more sweeping.

Immediately after my grad school graduation, I was paying almost $1000 a month toward student loans and barely making a dent. High-interest rates, plus a starting architect salary, NYC rent, and basic expenses meant that I was living month-to-month. With no family in the US, it was only after a friend agreed to be my guarantor that I managed to refinance for lower interest rates. As soon as I got my green card I applied to refinance my loans once again, this time all on my own. In the meantime, I was transitioning into management roles and my salary was getting increasingly higher, so I started paying off my loans more aggressively.

When I tried to refinance a third time during the pandemic to take advantage of even lower interest rates, I was denied. The reason? Because I had recently started my own practice. Despite years of stable employment, a perfect repayment record, hard-earned savings, tax returns showing that my new company was already profitable, and a regular teaching job, some formula decided that my income was too unpredictable (though obviously good enough to continue making regular monthly payments on a loan with less favorable terms). I am still paying off my student loans, but the end is in sight.

—Palmyra Geraki

A good question

I’m a designer pursuing architecture licensure. I used student loans to get through my M.Arch degree and graduated in 2011 when the economy was still sh*t, got a job in China, dodged the bills for a while, and moved back to the US in 2016, where my loans had ballooned. I have been chipping away at them as I financially recover. I sometimes wish I had done a +1 program, and I’m definitely glad I didn’t get into the Ivy I wanted at the time. About $75K left to go and, mostly, I wonder: if there’s ever a civil war do I still have to pay Navient?

—William Childress

It’s for the rich!

I’m an architect in New York with more student debt than anyone I’ve ever met or even heard of. I took out the loans because I wanted to be an architect, and it was the only way. I come from a poor family, and I didn’t have great options. I was not in a good place, and I didn’t want to be held back because I wasn’t rich. I made the best decision I could at the time. I also knew architects didn’t make “a lot” of money. So I knew I’d probably never pay off the debt. What I didn’t know was that even as a successful architect I would make less money than just about any other white-collar worker at the same level and that the early years of low pay would last so long that I wouldn’t be able to cover the interest on my loans, which cause the balance to explode. I ended up now, twelve years later, owing one-third more than I initially took out. My debt was going up six figures a year and I couldn’t afford to pay more. It’s a constant shame and source of anxiety that I keep hidden from the world. It has had a terrible effect on my mental health and on my career satisfaction.

The plan announced last week makes a huge difference for people like me. But if I could go back I would not do it again. Not necessarily because of the debt, but because architecture isn’t worth it. It’s one thing to have a lot of debt and do something you love and feel adequately compensated for, it’s another to be on the subway and feel like every other person on their way to an office has less debt than you and makes twice as much. We don’t get paid. Now I’m stuck, but at least my debt will never reach seven figures. I’ll take the crumbs.

It’s not fair, but architecture is a profession for the rich by the rich. It’s not for the rest of us. It’s too bad but that’s just the way it is.

—Anonymous

First generation

I grew up in public housing and nobody else in my family went to college. My parents had absolutely no way to even cover incidental costs for me. So I worked full-time as a server/bartender and took out $40K in loans for my undergraduate studies in landscape architecture at a state university. I’m about four years away from having them wiped out via PSLF, but they’ve shaped every career-related decision I’ve ever made (and will continue to do so until they’re gone). The $20k forgiveness for Pell recipients (like myself) and the new income-based repayment provisions and interest rate cap are huge. It’ll net us a few grand per year that’ll help us finally start saving for retirement.

—Billy Fleming

Barely a dent

I took out loans for a 4+1 architecture degree. After working for one year I decided that was not what I wanted to do, so I took out more loans for a post-professional master’s degree that I thought would help me pivot, and now I work in marketing for an architecture firm. Grad school loans are not eligible for the $20K max, even if you received a Pell Grant in undergrad. A $10K cancellation will barely put a dent in my total balance, and when payments/interest restart I will almost certainly accrue more than the amount forgiven in interest by the time I pay these off.

—Esti

DISPATCHES

9/1: The Start of Something?

A Successful Unionization

BROOKLYN—Pro-union advocates in architecture were given cause for celebration ahead of the Labor Day weekend. As reported by Noam Scheiber at The New York Times, employees at Bernheimer Architecture, a small design office in Brooklyn, successfully unionized after a two-year organizing process. (Evidently, the result had the backing of their boss, ANDREW BERNHEIMER.) Organizers from Architectural Workers United (AWU) active within the firm elected to join the International Association of Machinists and Aerospace Workers (IAMAW). ANDREW DALEY, an architect and IAMAW union rep, consulted with the organizers. “This historic movement marks the first union of a private sector architecture firm in at least seventy-five years,” he tells NYRA. “And it’s not possible without these workers, who were thoughtful, respectful of one another, and did the hard work to get to this point. We’re thrilled to see what they can do with it and how it pushes the industry forward.”

—Dan Jonas-Roche

9/1: Finding Land and Landings

Pratt Parallels: Land_ings

GOVERNORS ISLAND— Inside Nolan Park’s House no. 14, surrounded by models from the recently inaugurated exhibition Experimental Land-ings, Pratt GAUD chair DAVID ERDMAN led the departmental lecture series Pratt Parallels. JONATHAN SCELSA, co-curator of the exhibition, joined Erdman and a cast of students, architects, and educators that included JING LIU of SO-IL and Pratt interim dean QUILIAN RIANO on Governors Island to discuss pedagogy, climate change, architecture, generational change, and land. The panel engaged in a dynamic conversation about land, the role of architecture and architects in the fight against climate change, education, and even the future of humanity. The Thursday evening dynamic even delved into existential questions. In the words of Liu, “The most important thing in tackling climate change is changing ourselves.”

—Ekam Singh

EYES ON SKYLINE

In Skyline 80, readers were intrigued by the news of Noguchi’s studio becoming accessible to the public.

IN THE NEWS

This week,

…read more on the country’s only formal union at a private-sector architecture firm at Bernheimer Architecture…

…billboards are coming for West Hollywood to rival Tom Wiscombe’s Sunset Spectacular…

...a morbid display at Penn Station, as protestors preemptively mourn proposed demolitions…

…Moshe Safdie is donating his personal unit at Habitat 67 and his professional archive to McGill University…

…it’s the last week to visit Reset: Towards a New Commons at the Center for Architecture…

DATELINE

In the week ahead…

Saturday, 9/3

Walking Tour: FiDi’s Skyscrapers, Plazas, and the Impact of Zoning with Kyle Johnson

1:00 PM | Center for Architecture

Thursday, 9/8

Lightly/Casually with Rachaporn Choochuey

6:30 PM | Yale School of Architecture

Friday, 9/10

Walking Tour: Madison Avenue, High Fashion, and Historic Preservation with Kyle Johnson

5:00 PM | Center for Architecture

In Conversation with Sumayya Vally with Sumayya Vally

6:15 PM | Cornell Architecture Art Planning

First Friday: WXY architecture + urban design with WXY architecture + urban design

6:30 PM | The Architectural League of New York

Our listings are constantly being updated. Check the events page regularly for up-to-date listings and submit events through this link.

LETTER TO THE EDITOR

Have a take to share with NYRA? Write us a letter!

NYRA is a team effort. Our Deputy Editor is Marianela D'Aprile, our Editors at Large are Carolyn Bailey, Phillip Denny and Alex Klimoski, and our Publisher is Nicolas Kemper.

To pitch us an article or ask us a question, write to us at: editor@nyra.nyc.

For their support, we would like to thank the Graham Foundation and our issue sponsors, Tod Williams Billie Tsien Architects and Thomas Phifer.

To support our contributors and receive the Review by post, subscribe here.